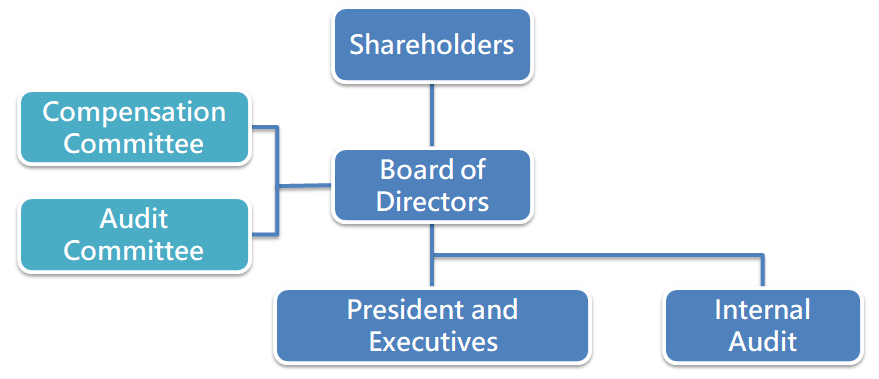

Corporate Governance-Corporate Governance Architecture

The Board of Directors resolved on May 26, 2022 to appoint Su, Yi-Fan, the Head of Financial Department, as the corporate governance officer.

The business operations in 2023 are as follows:

1.Handle matters in relation to the Board meetings and keep the meeting minutes according to law.

2.Determine whether the Board’s resolutions constitute material information to be disclosed.

3.Assist directors with their continuing education (director training has been disclosed in the Market Observation Post System).

4.Assist in the shareholders’ meeting procedures and compliance-related resolutions.

5.Check whether the Company meets the scoring criteria in corporate governance evaluation indicators.

6.Arrange for chief internal auditor and certified public accountants to communicate with independent directors.

7.Continuing Education of Corporate Governance Officer:

| Dates | Organizers | Courses/Topic Speeches | Durations |

| 2023/5/22 | Accounting Research and Development Foundation | Greenhouse gas inventories and Assurrance | 3 hours |

| 2023/6/2 | Chinese National Association of Industry and Commerce, Taiwan (CNAIC) | 2023 Taishin Net Zero Summit Go Towards Green Energy | 3 hours |

| 2023/7/4 | Taiwan Stock Exchange | Cathay Sustainable Finance and Climate Change Summit | 3 hours |

| 2023/7/26 | Taiwan Corporate Governance Association | Seminar on Board of Directors Performance Appraisal | 3 hours |

| 2023/10/25 | Accounting Research and Development Foundation | Intangible Assets Seminar | 3 hours |

| 2023/11/29 | Securities and Futures Institute | 2023 Insider Equity Transaction Law Compliance Publicity Briefing | 3 hours |

Implementation of Corporate Governance:

| Assessment Items | Implementation | Differences with Contents of Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies and Reasons | ||

| Y | N | Summary | ||

| 1. Does the company establish and disclose the Corporate Governance Best-Practice Principles based on “Corporate Governance Best-Practice Principles for TWSE/TPEx Listed Companies”? | V | The Company has established the Corporate Governance Best-Practice Principles based on “Corporate Governance Best-Practice Principles for TWSE/TPEx Listed Companies . The information has been disclosed on the Company’s website. |

None | |

|

2. Shareholding structure & shareholders’ rights (1) Does the company establish an internal operating procedure to deal with shareholders’ suggestions, doubts, disputes and litigations, and implement based on the procedure? (2) Does the company possess the list of its major shareholders as well as the ultimate owners of those shares? (3) Does the company establish and execute the risk management and firewall system within its conglomerate structure? (4) Does the company establish internal rules against insiders trading with undisclosed information? |

V |

(1) In addition to the existing hotline and email channels, the Company has established an internal operating procedure, and has designated appropriate departments, such as Investor Relations, Public Relations, Legal Department, to handle shareholders’ suggestions, doubts, disputes and litigation. (2) The Finance & Shared Services Division is responsible for collecting the updated information of major shareholders and the list of ultimate owners of those shares. (3) Rules are made to strictly regulate the activities of trading, endorsement and loans between the Company and its affiliates. In addition, the “Criteria of Internal Control Mechanism for a Public Company”, outlined by the Financial Supervisory Commission when drafting the guidelines for the “Supervision and Governance of Subsidiaries”, was followed in order to implement total risk control with respect to subsidiaries. (4) To protect shareholders’ rights and fairly treat shareholders, the Company has established the internal rules to forbid insiders trading on undisclosed information. The Company has also strongly advocated these rules in order to prevent any violations. |

None | |

| 1.

3. Composition and Responsibilities of the Board of Directors (1) Does the Board develop and implement a diversified policy for the composition of its members? (2) Does the company voluntarily establish other functional committees in addition to the Remuneration Committee and the Audit Committee? (3) Does the company establish a standard to measure the performance of the Board and implement it annually, and are performance evaluation results submitted to the Board of Directors and referenced when determining the remuneration of individual directors and nominations for reelection? (4) Does the company regularly evaluate the independence of CPAs? |

V |

(1) Member diversification is considered by the Board members. Factors taken into account include, but are not limited to gender, age, cultures, educational background, race, professional experience, skills, knowledge and terms of service. The Board objectively chooses candidates to meet the goal of member diversification. (2) The Company has set up the Remuneration Committee and the Audit Committee according to the law; the establishment of other committees is under evaluation. (3) The company has formulated rules and procedures for evaluating the Board’s performance and conducts it annually. The Company uses two methods to evaluate the performance of the Board. 1. Self-assessment of Board members A. Their grasp of the Company's goals and missions; B. Their recognition of director's duties; C. Their degree of participation in the Company's operations; D. Their management of internal relationships and communications; E. Their professionalism and continuing professional education; F. Internal controls. 2. Assessment of the Board: A. The degree of participation in the Company's operations; B. Improvement in the quality of decision making by the Board of Directors; C. The composition and structure of the Board of Directors; D. The election of the directors and their continuing professional education. E. Internal controls. F. The external board performance evaluation is conducted at least once every three years by an external professional independent organization or a team of external expert scholars, and an annual performance evaluation is conducted at the end of each year. At the end of 112th year, our company commissioned the external organization " Taipei Foundation of Finance " to conduct a board performance evaluation for the period from January 2022 year to December 2023 year. The association issued the evaluation report on March 18th, 2024 year. For the overall evaluation and recommended actions, please refer to the Corporate Governance section on our company's website. (4) The Company evaluates the independence of CPAs annually, ensuring that that they are not stakeholders such as a Board member, supervisor, shareholder or person paid by the Company. |

None | |

| 4. Does the company appoint a suitable number of competent personnel and a supervisor responsible for corporate governance matters (including but not limited to providing information for directors and supervisors to perform their functions, assisting directors and supervisors with compliance, handling work related to meetings of the board of directors and the shareholders' meetings, and producing minutes of board meetings and shareholders' meetings)? | V | The board of directors approved Su, Yi-Fan the appointment of corporate governance officer .The responsibility of for corporate governance officer include corporate governance-related matters, providing information required by directors and functional committees to perform their business, drafting agendas of the board of directors and shareholders’ meeting and assisting the board of directors to strengthen their functions. | None | |

| 5. Does the company establish a communication channel and build a designated section on its website for stakeholders (including but not limited to shareholders, employees, customers, and suppliers), as well as handle all the issues they care for in terms of corporate social responsibilities? | V | The Company provides detailed contact information, including telephone numbers and email addresses in the “Stakeholder Area” section of the corporate website. In addition, personnel are in place to exclusively deal with issues of social responsibility, ensuring that various interested parties have channels to communicate with the Company. | None | |

| 6. Does the company appoint a professional shareholder service agency to deal with shareholder affairs? | V | The Company designates Agency Department of Chinatrust to deal with shareholder affairs. | None | |

|

7. Information Disclosure (1) Does the company have a corporate website to disclose both financial standings and the status of corporate governance? (2) Does the company have other information disclosure channels (e.g. building an English website, appointing designated people to handle information collection and disclosure, creating a spokesman system, webcasting investor conferences)? (3) Does the company announce and report annual financial statements within two months after the end of each fiscal year, and announce and report Q1, Q2, and Q3 financial statements, as well as monthly operation results, before the prescribed time limit? |

V |

(1) The Company has set up a Chinese/English website (www.scottselmanoff.com) to disclose information regarding the Company’s financials, business and corporate governance status. (2) The Company has established a spokesman system. Investor conference information is disclosed on the corporate website. (3) The Company has reported annual financial statements within two months after the end of each fiscal year and announced them on the company website. |

None | |

| 8. Is there any other important information to facilitate a better understanding of the company’s corporate governance practices (e.g., including but not limited to employee rights, employee wellness, investor relations, supplier relations, rights of stakeholders, directors’ and supervisors’ training records, the implementation of risk management policies and risk evaluation measures, the implementation of customer relations policies, and purchasing insurance for directors and supervisors)?Please refer to note2. | ||||

| 9. Please explain the improvements which have been made in accordance with the results of the Corporate Governance Evaluation System released by the Corporate Governance Center, Taiwan Stock Exchange, and provide the priority enhancement measures. Every year, the company reviews the indicators that have not yet met the scoring standards based on the recent corporate governance evaluation results and the corporate governance evaluation indicators released in the most recent year, arranges improvement schedules, and has completed the improvement of most of the projects that did not meet the standards. | ||||

Note 1: CPAs' independence evaluation criteria

| Items for Evaluation | Evaluation Result | Compliance with Independence |

| 1.As of the most recent Assurance Service, there has been no instance where the CPA has remained unchanged for seven years. | Y | Y |

| 2. The CPA has no significant financial interests with the principal. | Y | Y |

| 3. The CPA avoids any inappropriate relationships with the principal | Y | Y |

| 4. The accountant should ensure that their assistant personnel adhere to honesty, fairness, and independence. | Y | Y |

| 5. Financial statements of the serving organization within the first two years of practice shall not be audited for certification. | Y | Y |

| 6. The accountant's name must not be used by others. | Y | Y |

| 7. Does the Accountant serve as the Defense Attorney for the Company or have coordinated the Company’s conflicts with any other third parties on behalf of the Company? | Y | Y |

| 8. The CPA has not engaged in any monetary borrowing or lending with this company or related enterprises. | Y | Y |

| 9. The CPA does not have a common investment or shared interest relationship with this company or its affiliated enterprises. | Y | Y |

| 10. The CPA does not concurrently hold regular employment with this company or its affiliated enterprises and receive fixed salary. | Y | Y |

| 11. The CPA is not involved in managerial functions related to decision-making for this company or its affiliated enterprises. | Y | Y |

| 12. The CPA does not engage in other businesses that may compromise their independence. | Y | Y |

| 13. The CPA does not have any spousal, direct blood relationship, direct in-law relationship, or second-degree collateral blood relationship with the management personnel of this company. | Y | Y |

| 14. The CPA does not receive any commissions related to business activities. | Y | Y |

| 15. As of now, the CPA has not been subject to any disciplinary actions or incidents compromising their independence principles. | Y | Y |

Note2:Other important information to facilitate a better understanding of the company’s corporate governance practices

1. Employees’ rights and interests, employee care, investor relations, supplier relationship, and stakeholders’ rights

The Company’s culture is Service, Elaboration, Family and Innovation. Making considerable investment in employee benefits & work rights and investor relations. The company has been held Badminton Competition since 2016.

In terms of employees’ rights & interests and employee care, the Company takes relevant government laws and regulations such as Labor Standards Act, Act of Gender Equality in Employment, Sexual Harassment Prevention Act, etc. as benchmarks for the formulation of personnel management regulations to protect employees’ rights and interests. In addition to the announcement and implementation of the said regulations, labor-management meetings are regularly held to facilitate effective communication.

Moreover, "Employee Welfare Committee" has been set up, and funds are allocated on a monthly basis for organizing regular activities to enhance employees’ welfare. Detailed benefits programs and budget planning are carried out every year, including gift vouchers for festivals, health-promotion and leisure activities for employees, family days, local/overseas tours, wedding and funeral subsidies, hospitalization subsidies for employees and their families, prizes for year-end parties, health check, labor/health/group insurance, etc.

In terms of investor relations, the Company has set up a dedicated Investor Relations Department to act as a communication bridge between the Company and investors for investors to fully and promptly understand the Company's business achievements/ performance and long-term operational strategies/direction, thereby providing investors, analysts and domestic/international professional investment institutions with the best services.

In regards to supplier selection, the Company continues to promote green procurement by requiring raw material suppliers to provide declarations guaranteeing that their products do not contain prohibited substances that are harmful to the environment.

With respect to stakeholders' rights, the Company has created a Stakeholder section on its website, and has set up Independent Director’s Mailbox to establish a direct communication channel between the Company and employees, shareholders and stakeholders for the protection of stakeholders' rights.

2. Continuing studying status for directors and independent directors.

| Names | Dates | Organizers | Courses | Training hours |

| WANG/GUANG-SHIAH | 2023/6/2 | Chinese National Association of Industry and Commerce, Taiwan (CNAIC) | 2023 Taishin Net Zero Summit Go Towards Green Energy | 3hours |

| 2023/11/29 | Securities and Futures Institute | 2023 Insider Equity Transaction Law Compliance Publicity Briefing | 3hours | |

| CHANG/YUNG-YANG | 2023/11/7 | Taiwan Project Management Assoclation | International industry trends and management of multinational enterprise operations | 3hours |

| 2022/11/30 | Securities and Futures Institute | ChatGPT technology development and application opportunities | 3hours | |

| YU/MING-CHANG | 2023/8/17 | Securities and Futures Institute | Introduction to short-term trading of company insiders and case analysis | 3hours |

| 2023/11/15 | Securities and Futures Institute | 2023 Insider Equity Transaction Law Compliance Publicity Briefing | 3hours | |

| CHUANG/YUNG-SHUN | 2023/3/27 | Chinese National Association of Industry and Commerce, Taiwan (CNAIC) | Corporate Resilience and Taiwan's Competitiveness | 3hours |

| 2023/4/13 | TAIWAN ACADEMY OF BANKING AND FINANCE | Corporate Governance | 3hours | |

| YAN/WEI-CHYUN | 2023/3/27 | Chinese National Association of Industry and Commerce, Taiwan (CNAIC) | Corporate Resilience and Taiwan's Competitiveness | 3hours |

| 2023/6/2 | Chinese National Association of Industry and Commerce, Taiwan (CNAIC) | 2023 Taishin Net Zero Summit Go Towards Green Energy | 3hours | |

| CHEN/FU-SHEN | 2023/4/27 | Taiwan Stock Exchange | Promotion of sustainable development action plans for publicly traded companies | 3hours |

| 2023/6/2 | Chinese National Association of Industry and Commerce, Taiwan (CNAIC) | 2023 Taishin Net Zero Summit Go Towards Green Energy | 3hours | |

| 2023/11/29 | Securities and Futures Institute | 2023 Insider Equity Transaction Law Compliance Publicity Briefing | 3hours | |

| LEE/TSU-DER | 2023/7/5 | Securities and Futures Institute | The political economy of the Chinese Communist Party, the international situation and cross-strait relations | 3hours |

| 2023/10/13 | Securities and Futures Institute | How directors supervise the company's enterprise risk management and crisis management | 3hours | |

| YEN/TZONG-MING | 2023/9/13 | Taiwan Corporate Governance Association | Corporate Governance and ESG | 3hours |

| 2023/9/28 | Taiwan Institute of Directors | Thinking outside the organizational framework and the key point of enterprise transformation strategy | 3hours | |

| DU/MING-HAN | 2023/12/14 | Taiwan Project Management Association | Analysis of stakeholders in corporate governance and integrated project management | 3hours |

| 2023/12/21 | Taiwan Project Management Association | ESG investing and CSR | 3hours |

3. Advanced Studies of Managers:

| Names | Dates | Organizers | Courses/Topic Speeches | Durations |

| WANG/GUANG-SHIAH | 2023/6/2 | Chinese National Association of Industry and Commerce, Taiwan (CNAIC) | 2023 Taishin Net Zero Summit Go Towards Green Energy | 3hours |

| 2023/11/29 | Securities and Futures Institute | 2023 Insider Equity Transaction Law Compliance Publicity Briefing | 3hours | |

| CHEN/FU-SHEN | 2023/4/27 | Taiwan Stock Exchange | Promotion of sustainable development action plans for publicly traded companies | 3hours |

| 2023/6/2 | Chinese National Association of Industry and Commerce, Taiwan (CNAIC) | 2023 Taishin Net Zero Summit Go Towards Green Energy | 3hours | |

| 2023/11/29 | Securities and Futures Institute | 2023 Insider Equity Transaction Law Compliance Publicity Briefing | 3hours | |

| SU/YI-FAN | 2023/5/22 | Accounting Research and Development Foundation | Greenhouse gas inventories and Assurrance | 3hours |

| 2023/6/2 | Chinese National Association of Industry and Commerce, Taiwan (CNAIC) | 2023 Taishin Net Zero Summit Go Towards Green Energy | 3hours | |

| 2023/7/4 | Taiwan Stock Exchange | Cathay Sustainable Finance and Climate Change Summit | 3hours | |

| 2023/7/26 | Taiwan Corporate Governance Association | Seminar on Board of Directors Performance Appraisal | 3hours | |

| 2023/10/25 | Accounting Research and Development Foundation | Intangible Assets Seminar | 3hours | |

| 2023/11/29 | Securities and Futures Institute | 2023 Insider Equity Transaction Law Compliance Publicity Briefing | 3hours | |

| 2023/12/18 | Accounting Research and Development Foundation | Accounting Manager Continuing Education Course | 12hours |